Does Your Business Have a Website?

Does Your Business Have a Website?

If so, you may be entitled to certain tax deductions.

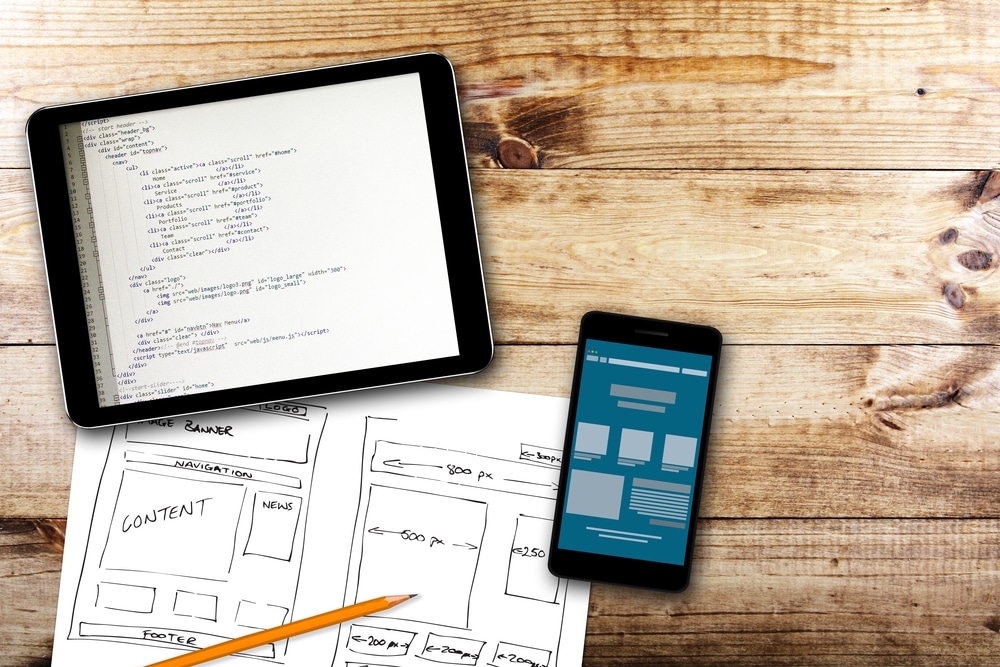

Whether you are planning to start a new business or looking to advertise your existing business, having a website is a good marketing strategy. It’s also a good tax planning strategy if you’re looking to reduce taxable income. Developing a functional website may be difficult, but taking the tax deduction is easy. Just keep track of the following expenses:

- Computers and peripherals, including monitor, mouse, keyboard, and printer. Note whether it is new or used, so bonus depreciation can be taken if eligible.

- Internet and phone charges.

- Consultant fees (an expert can be helpful for a quick set-up and thoughtful design).

- Domain registration fees.

- Web hosting fees (monthly or annual).

- Software used to develop and maintain the site.

If you receive one of these letters, contact us as soon as possible. In most cases, the IRS expects a response within 30 days. A failure to respond, when required, might result in a proposed assessment of additional tax or further compliance action.